BEIJING, Oct. 22, 2024 /PRNewswire/ -- Themed on "Trust and Confidence - Work Together to Promote Financial Openness, Cooperate for Shared Economic Stability and Growth", the Annual Conference of Financial Street Forum 2024 concluded on Sunday.

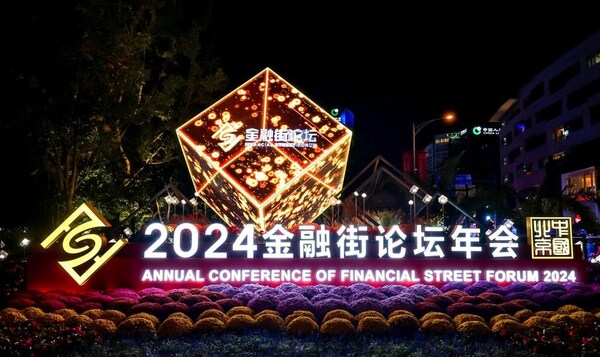

Photo shows the exterior scene of the venue of the Annual Conference of Financial Street Forum 2024 held in Beijing on October 18, 2024.

During the event, Chinese and foreign participants have conducted in-depth discussions on current economic and financial hot topics in an attempt to enhance mutual trust, deepen win-win cooperation and share development opportunities.

Many foreign institutions expressed their willingness to further promote investment in China at this year's conference.

Both China and Germany are facing social challenges such as aging problem, said Markus Kobler, the CFO and member of the executive board of DWS Group, adding that the two sides can establish an open financial market, expand bilateral investment, strengthen financial and asset management cooperation, and jointly develop strategic emerging industries, such as green technology and transportation automation, to achieve win-win results.

Noting how to deepen the financial sector's role in serving the real economy, Weng Qiwen, director of China Centre for Promotion of SME Development, said that the new round of industrial revolution requires matching financial innovation and financial reform.

According to Weng, it is necessary to cultivate the "craftsman spirit" of the capital market and guild long-term capital into the financial market in an attempt to advance the development of new quality productive forces.

Regarding the current financial challenges related to new technologies, new applications and new risks, Li Yang, chairman of National Institution for Finance & Development, believes that the correct financial function is the basis for preventing financial risks.

According to Li, more efforts should be made to further balance the relationship between functionality and profitability, deal with the relationship between lifting financial repression and preventing excessive financialization, continue to reduce circulation costs and financing costs, and meet the diversified financing needs of the national economy.

Original link: https://en.imsilkroad.com/p/342711.html