Asia-Pacific Disclosure Performance Lowers Compared to Previous Year

SDGs Midterm Roundup, Enterprises May Face SDG Washing Crisis

[Five Key Findings]*please refer to complete report for detailed research findings

- [Overall Performance] Northeast Asian enterprises take Top 3 of the Top 10 Regional Sustainability Results. Asia-Pacific ESG standards reach over 550, but overall disclosure performance average decreases by 6.9%

- [Value Chain, Net-Zer] Value chain decarbonization era is here. 56.2% of Asia-Pacific enterprises have not included Scope 3 in their net-zero targets

- [Biodiversity] T-x-FD multiverse. 12.5% of enterprise management expands vision to "natural capital" and sets biodiversity targets

- [Social Rights] "DEI+J" shifts sustainability perspective from Environment to Social, up to 92.7% of enterprises publicly explains their "social justice and human rights"

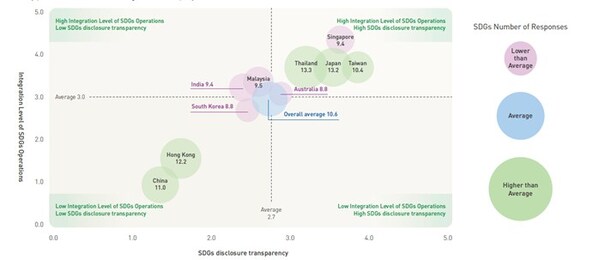

- [Greenwashing Issues] SDGs washing becoming a trend. Singapore highest level of management activeness while China and Hong Kong have high responses but less capable to take action

TAIPEI, June 3, 2024 /PRNewswire/ -- CSRone Intelligence Platform (CSRone), leading sustainability brand in Taiwan, officially publishes the 2024 Asia-Pacific Sustainability Report Current Status and Trend on 10 Countries. The report studied 10 Asia-Pacific countries/regions and the Top 10 enterprises based on market value shared by Forbes. The overall performance ranking placed Taiwan as first place again, with South Korea and Japan taking second and third place, respectively. However, the overall performance average for Asia-Pacific enterprise sustainability disclosure dropped compared to the previous year. The research further discovered that there is a gap between corporate promises and their actual outcomes, causing the "sustainability promise bubble" to become more apparent.

The Asia-Pacific spans across the Pacific region including parts of Asia, America, and Oceania. Accounting for 60% of the world's population and over 50% of global economic trade, Asia-Pacific plays a significant role in the transformation of the world's economic growth and sustainability development. The 2024 Asia-Pacific Sustainability Report Current Status and Trend on 10 Countries published by CSRone is based on the disclosure transparency and management activeness gap, relative laws, and enterprise and industry relationship analyzation on the gathered sustainability performance, net-zero strategy, regulation standard, and industry data.

Overall Asia-Pacific enterprise sustainability disclosure performance drops, 56.2% have not included Scope 3 in their net-zero target

Based on cross-research on the ESG regulation development and enterprise disclosure activeness relationship, Europe announced a total of 776 policies from 1990 until 2020, becoming the most active policy announcement region. Asia-Pacific follows closely by announcing 556 ESG-related policies, but the overall Asia-Pacific disclosure performance did not rise according to the disclosure performance policies. This year's study shows that the best performance countries/regions are Taiwan, South Korea, and Japan, demonstrating a comprehensive ESG issue management and communication. A closure analyzation discovers that the Top 10 Asia-Pacific rating lowered by 6.9% which is due to enterprises' detailed description on ESG behavior and performance but disclosure on target and validation being conservative or nonexistent. Enterprises' decarbonization value chain action is closely linked to their accomplishment of their net-zero target; the greenhouse gas emissions management of Scope 1 to Scope 3 of is top priority. 70.8% of the enterprises have already set net-zero goals, but up to 56.2% have not included Scope 3 in their goal setting and disclosure range. Enterprises must management their up- and down-value chain quickly in order to reach their net-zero goals.

2024 Top 10 Asia-Pacific Enterprise Sustainability Ranking; based on the five evaluations including mention, action, performance, goal, and evaluation. The higher the evaluation score, the more complete the disclosure transparency of a country/region’s key subject.

Sustainability vision expands continuously, attention on natural capital and social rights increases

Throughout the sustainability framework integration progress, TCFD have expanded to TNFD. The environmental aspect have shifted from the highly attentive climate change and carbon issues towards biodiversity and ecosystem operation including soil and water resource utilization. Up to 95.8% of Asia-Pacific enterprises have mentioned ecosystem balance and biodiversity, with 12.5% setting goals regarding this topic. However, only 2.1% of the enterprises have a validation mechanism, meaning that enterprises need a more comprehensive evaluation regarding core operations and natural capital management.

In addition, the Social aspect of ESG have always had a slower progress compared to the Environment aspect. According to research, 97.9% of the enterprises stress DEI as one of their corporate sustainability development issues by mentioning the value of talent diversity during recruitment and retainment. In recent years, international conflicts continue to occur due to gender and racial confrontations. As a result, countries/regions and enterprises are including Justice in their DEI management. Up to 92.7% of the enterprises have publicly shared their "Social Justice and Human Rights" issue. Although there is high attention for natural capital and social rights, the implementation of these management goals and validation mechanism have greatly lowered.

Most enterprises only disclose SDGs but rarely accomplish goals

Over half of the time has passed since the SDGs' introduction in 2015 until now; now is the time to start assessing progress and outcomes. Taiwan, Singapore, and Japan are leading when it comes to pushing the SDGs goals, with Singapore positioned as first place for overall SDGs operation integration. What's worth noticing is that up to 89.6% of the countries/regions "mention" SDGs but only 32.3% set goals and carry out their promises and only 5.2% establish a validation mechanism. Research shows that China and Hong Kong enterprises remain in the stage where they discuss the connection between SDGs and their corporate development direction but do not have specific SDGs programs for improvement.

The ten Asia-Pacific countries play a significant role in economic, trade, and sustainability transition. The main point is to close the gap between national policies and enterprises' progress. If there are not any concrete commitments or implementation, SDGs goals are merely words. Enterprises must contemplate more on the materiality between SDGs and their operations to prevent SDG washing and its negative impact and operational shock.

Thailand, Japan, Hong Kong, China, and Taiwan’s SDGs response are more diverse. Malaysia, India, Singapore, South Korea, and Australia’s SDGs are more focused.

[News Material]

- News Material Download: https://reurl.cc/LWQd8y

- Full Report Download: https://csrone.com/reports/6806

[About the Beyond Sustainability! Trends of Sustainability in Asia-Pacific]

CSRone Intelligence Platform has conducted an annual survey and analysis of sustainability information disclosure in Taiwan since 2013, with results regularly published in March. Starting in 2018, the database for the report expanded its collection to include the sustainability reports of the top 10 companies from 10 countries and regions in the Asia-Pacific, including China, Japan, India, South Korea, Hong Kong, Malaysia, Singapore, Taiwan, and Australia.

The research led by senior consultants Richard Chen, Alice Chang, and Tracy Ni with a research team, sets out six major research hypotheses and uses 185 indicators, sets out six major research hypotheses and uses 185 analysis indicators. It deeply deconstructs the differences between "disclosure transparency" and "management proactiveness" while examining the relationships among national regulations and between companies/industries. The report analyzes information on sustainability performance, net-zero strategies, SDGs, DEI, legal regulations, and industry trends. This report enables stakeholders to understand how companies in the Asia-Pacific region practice sustainable development, making it one of the best guides for understanding sustainability trends in this region.

[Research Sample and Period]

- Sample Collection: A total of 96 sustainability reports from 10 Asia-Pacific countries/regions were collected.

- Research Subjects: The 10 Asia-Pacific countries/regions include Taiwan, Japan, China, Hong Kong, India, Singapore, Malaysia, Thailand, Australia, South Korea. The Top 10 enterprises selected are based on the disclosed sustainability report/data based on the Forbes global 2,000 enterprises.

- Research Period: Publicly published 2023 sustainability reports, with disclosure period being 2022/1/1 until 2022/12/31; parts of disclosed information of the sustainability report may differ due to enterprise disclosure difference.