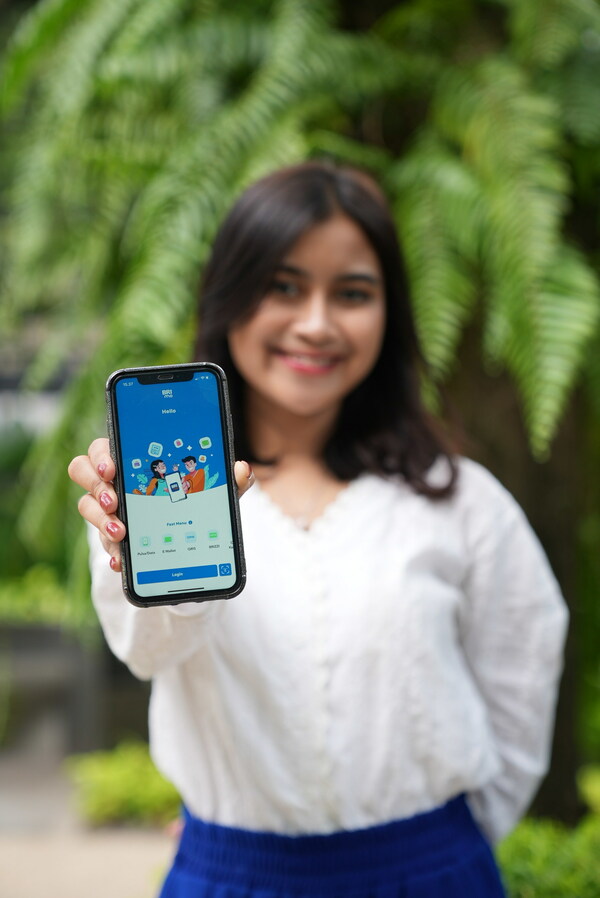

With a flourishing user base, the app expands the bank's customer-focused services digitally while revolutionizing the Indonesian banking landscape.

JAKARTA, Indonesia, April 2, 2024 /PRNewswire/ -- PT Bank Rakyat Indonesia (BRI) Persero Tbk. (IDX: BBRI) is unveiling the major success of BRImo, its flagship app for mobile banking services that are accessible anytime, anywhere. Launched in 2019, BRImo has already grown its database from 2.9 million to 31.6 million total users and reached IDR 4.158 trillion transaction value in December 2023. The number surpassed the reach of numerous other mobile banking solutions from its peers.

(Jakarta 04/02)- BRImo, Bank Rakyat Indonesia's innovative mobile banking app, surpasses 30 million users marking a significant stride towards financial inclusion in Indonesia.

BRImo's burgeoning user base demonstrates BRI's commitment to advancing financial literacy and inclusion. BRImo helps BRI in transforming Indonesian banking landscape into a more inclusive, accessible, user-centric, and mobile-first environment.

BRImo empowers users with diverse in-app features, including seamless digital account opening in 11 currencies and access to 5 years of transaction history. Additionally, users can benefit from multi-currency savings options, international remittance management, forex conversion services, and cross-border QR code-based payments. The app's cashless transactions and financial monitoring help micro, small, and medium enterprises (MSMEs) to grow by facilitating financial management. It leverages BRI's strong presence to expand banking services for retailers in urban areas.

Striving for maximum reliability, BRImo is equipped with cutting-edge technology that ensures a 99.8% transaction success rate. The app also delivers advanced data security with various global certifications and layered measures, including facial recognition, fingerprint, PINs, OTPs, and passwords.

As one of the largest financial institutions in Indonesia, BRI continuously seeks to creating economic value and social value, while contributing to nurturing the environment. BRImo's mobile-based services advance the bank's efforts by promoting paperless transactions and helping to reduce transportation emissions from the customers. BRImo potentially helped users reduce their carbon footprints by 597,105 kgCO2e throughout 2023, while facilitating financial inclusion by expanding access to banking services.

"Focusing on customer excellence has been at the heart of BRImo's journey. BRImo's impressive growth reflects its responsiveness to customer needs, and we strive for various innovations such as simplifying banking processes, and empowering customers with BRImo's outstanding features," concluded Sunarso, President Director of BRI.

For more information on BRI and BRImo, please visit www.bri.co.id