SHENZHEN, China, Jan. 31, 2024 /PRNewswire/ -- Leading IT market research and advisory firm International Data Corporation (IDC) published its latest case study report, How Does WeBank Lead the Way Among Digital Banks Worldwide? (Doc # CHE50976724,January 2024) The report recognizes WeBank as the benchmark in the development of digital bank worldwide.

The report provides an in-depth analysis of the successful practices of WeBank as a world-leading digital bank in terms of its innovation in technology, digital inclusive finance business model, digital risk management and user experience.

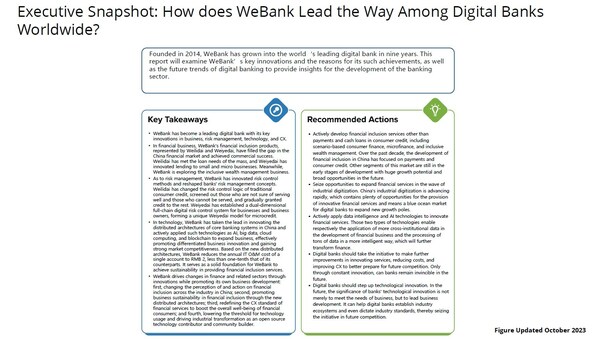

(Executive snapshot from How Does WeBank Lead the Way Among Digital Banks Worldwide? (CHE50976724) published on 31 January 2024)

"WeBank's innovative ideas and methods in digital bank development are not only applicable to itself but also highly valuable for all digital banks, traditional banks, and other financial institutions," Alice Wen, research manager at Financial Insights, IDC China, says, "it is recommended that financial institutions fully leverage emerging technologies to actively adopt a blue ocean strategy in developing financial inclusion business, while maintaining a sense of crisis and continuous innovation to gain the initiative and advantage in the future competition."

WeBank Takes Fintech and Innovations to Drive the Development of Businesses

Amid the rise of digital banks across Asia, Europe, and the Americas, WeBank takes a prominent position by leveraging financial technology to introduce innovative products in China's financial sector.

The report fully analyzes the resources WeBank has committed to the research and development of core and key technologies such as Artificial Intelligence, Blockchain, Cloud Computing, and Big Data (ABCD) to construct as well as support its business. Notably, WeBank's Openhive-based distributed core banking system has ensured a secure, efficient, and superior digital customer experience catering to its growing consumer base.

Simultaneously, WeBank advocates for FinTech open source on two fronts: internally via its open-source governance system, and externally through open-source projects centering around ABCD technologies. By June 2023, WeBank had successfully launched 35 open-source projects.

WeBank as an Example of Digital Banking in Financial Inclusion

Entering its tenth year, China's inclusive finance development, featuring digital finance variables, is key in the government's agenda to boost the nation's financial strength.

WeBank's strides in this field have filled market gaps and demonstrated the great potential of sustainable inclusive finance within commercial businesses. It brings lasting changes in perceptions within financial institutions from the aspects of FinTech capability, digital product innovation, risk management and customer experience. By now, WeBank has delved into two segments, namely consumer finance and MSME (small and medium-sized enterprises) finance, providing high-quality services to over 370 individual customers and 4.1 million micro, small and medium-sized entities in China. Its successful innovation in inclusive finance has led to ripple effects in industry development, making it a desirable model even for global digital banks.

In November 2023, WeBank was awarded the honor of "Special Award for Digital Native Business" by IDC Future Enterprise Awards in Asia-Pacific region, acknowledging its forward-thinking and exceptional innovation.

Full report:

https://www.idc.com/getdoc.jsp?containerId=CHE50976724&pageType=PRINTFRIENDLY

About WeBank

Launched in 2014, WeBank Co., Ltd. ("WeBank") is the first digital bank in China. WeBank provides more convenient financial services to micro-, small- and medium-sized enterprises (MSMEs) and the public, and continuously improves the quality of services in response to customers' specific needs. As one of the top 100 banks in China, WeBank now ranks 284 in the Top 1000 World Banks by The Banker.

WeBank focuses on innovation and technology. As the first commercial bank to obtain the national high-tech enterprise certification in China, WeBank has maintained its proportion of technical personnel above 50% since its establishment, while its research and development expenses of accounted for around 10% of its revenue. WeBank is now at the top of the industry in core technologies such as artificial intelligence (AI), blockchain, cloud computing and big data.