|

PARIS, Jan. 18, 2023 /PRNewswire/ -- As a sales-based indicator, our Artprice100© index reflects a purely financial approach to art that in no way replaces the non-financial relationships between art collectors and artists. In essence, our index reveals the hypothetical financial result you would obtain if you were to invest in the world's top-selling artists to benefit financially from their success.

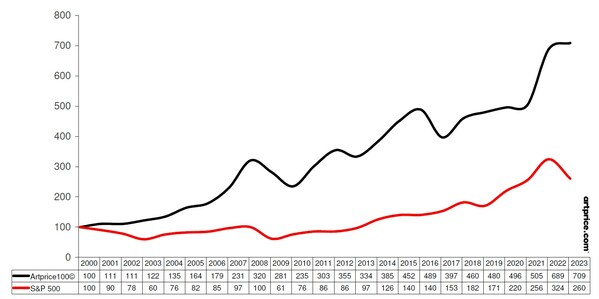

Artprice100© vs. S&P 500 – Base 100 in January 2000

Infographic - https://mma.prnasia.com/media2/1985066/Artprice100_Infographic.jpg?p=medium600

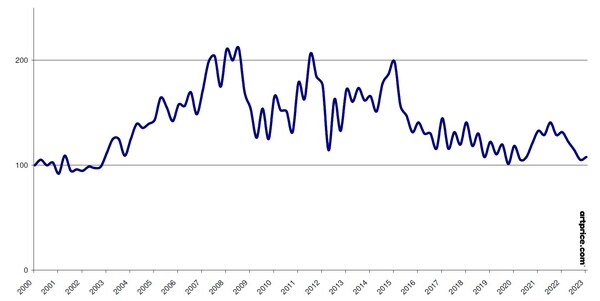

Artprice Global Index – Base 100 in January 2000

Infographic - https://mma.prnasia.com/media2/1985067/Artprice_Global_Infographic.jpg?p=medium600

"In financial terms, investing in art masterpieces has never been so costly, with auction prices nowadays often reaching eight or nine figures in US dollars. But, at the same time, thanks to joint ownership solutions, it has never been so easy", says thierry Ehrmann, CEO of Artmarket.com and Founder of Artprice.

The Artprice100© index is therefore an essential market benchmark: a purely theoretical exercise simulating investment in the art market's 100 most successful artists without any other aesthetic or preferential consideration. To calculate the index, we construct a portfolio of the world's 100 top-selling artists based on their auction revenue over the previous five years (in this case, 1 January 2017 to 31 December 2021). We also apply a liquidity criterion: for each artist, at least ten works (excluding prints and multiples) must have been auctioned annually for them to be included in the calculations (see list of included artists below).

The economic context and art market trends

In global terms, the year 2022 was marked by a range of issues including the fallout and persistent economic impact of the global covid pandemic (inflation, China…) and the new economic challenges posed by the war in Ukraine, notably in terms of energy. Over the 12 months of 2022, the S&P 500 lost 19% of its value while crypto-currencies entered a bear market that substantially slowed NFT transactions.

However, despite these drags on the global economy, the global art auction market had a prosperous year and, indeed, one of the best in its history. Artprice attributes this good performance primarily to the successes achieved by American auction houses, posting record sales with truly sensational results in the painting medium, but also in photography and tapestry. And, as you will see in our comprehensive 2022 Global Art Market Report (to be published at the beginning of March 2023 on www.artprice.com), strong results in France, Germany, and Hong Kong also stabilized the global art auction market.

Among the art market's principal trends in 2022, Artprice noted the more intense than ever competition for masterpieces from the most prestigious collections, which included the Hubert de Givenchy, Thomas Ammann, Yusaku Maezawa, and of course the Paul G. Allen collections. The year's results also showed a continuing voracious appetite for works by very young artists (Ultra-Contemporary Art), to which Artprice devoted its last Annual Report.

www.artprice.com/artprice-reports/the-contemporary-art-market-report-2022

Our Global Artprice Index was down 18% in 2022, but our Artprice100© gained 3%

Excepting the ultra-high-end of the art market, the global economic context nevertheless prompted art buyers to adopt a generally more cautious stance. With 1 million lots presented worldwide (as recorded by Artprice by Artmarket.com in 2022), the offer has once again expanded to an unprecedented level, with more than half of the transactions (56% of lots sold) concluded below the threshold of $1,000 (including fees).

So, while our Blue-chip 100 Artists Index shows slight growth over the past twelve months (+3%), overall art market prices posted a contraction of 18%: almost the same contraction as the S&P 500 index. The causes are many and varied, starting with the suspension of art auctions in China and the weakening of the euro against the dollar.

It should be noted that many artworks that reached sensational results in auction rooms during 2022 cannot be included in the calculation of our Artprice Global Index. Extremely rare works such as Georges Seurat's Les Poseuses (1888) or fresh canvases such as Avery Singer's Happening (2014) are not included in the calculation of the Global Indices either because there is no repeat sales history, or because there is not enough data to use a hedonic valuation method. For example, there may not be enough similar works in circulation or there is still too little hindsight to assess the value of these works on a regular basis (annually or quarterly).

www.artprice.com/artist/26469/georges-seurat/painting/28444347/les-poseuses-ensemble-petite-version

www.artprice.com/artist/611277/avery-singer/painting/26880003/happening

Lastly, the progression of the Arptrice100© index may, in itself, seem weak considering the spectacular results recorded in 2022 for blue-chip artists. However, this index takes into consideration all the works sold by the 100 top-selling and most liquid signatures, and some of these works were much less successful than the most legendary pieces.

For example, the third-best result of the year 2022 was hammered for Paul Cézanne's La Montagne Sainte-Victoire (1888-1890). Acquired in 2001 for $38.5 million, this painting was resold for $137.8 million (incl. fees) this year as part of the Paul G. Allen Collection. However, a few days later (17 November), another painting by Cézanne, Maisons au Chou, à Pontoise (circa 1881), acquired in 2007 for $6.8 million, was resold for just $3.7 million at Christie's in New York.

So, if we compare the Artprice100© and the Global Artprice indices, we see that blue-chip artists managed to get through an economically challenging year with a slight increase in market value and that the rarest masterpieces by these blue-chip signatures clearly posted the best returns.

The Artprice100© index: Artist + portfolio weighting in 2022

1. Pablo PICASSO (1881-1973). 8.6%

2. Jean-Michel BASQUIAT (1960-1988). 4.4%

3. Andy WARHOL (1928-1987). 4.2%

4. Claude MONET (1840-1926). 4.0%

5. ZAO Wou-Ki (1921-2013). 3.8%

6. QI Baishi (1864-1957). 2.8%

7. Gerhard RICHTER (1932-). 2.6%

8. FU Baoshi (1904-1965). 2.2%

9. WU Guanzhong (1919-2010). 2.1%

10. David HOCKNEY (1937-). 2.1%

11. Yayoi KUSAMA (1929-). 1.9%

12. Roy LICHTENSTEIN (1923-1997). 1.7%

13. René MAGRITTE (1898-1967). 1.7%

14. Vincent VAN GOGH (1853-1890). 1.7%

15. Cy TWOMBLY (1928-2011). 1.7%

16. Alberto GIACOMETTI (1901-1966). 1.6%

17. SAN Yu (1895/1901-1966). 1.6%

18. Alexander CALDER (1898-1976). 1.5%

19. Marc CHAGALL (1887-1985). 1.5%

20. Willem DE KOONING (1904-1997). 1.4%

21. Joan MIRO (1893-1983). 1.4%

22. Yoshitomo NARA (1959-). 1.3%

23. CUI Ruzhuo (1944-). 1.3%

24. Jean DUBUFFET (1901-1985). 1.2%

25. Lucio FONTANA (1899-1968). 1.1%

26. BANKSY (1974-). 1.1%

27. Amedeo MODIGLIANI (1884-1920). 1.1%

28. Joan MITCHELL (1925-1992). 1.1%

29. Henri MATISSE (1869-1954). 1.0%

30. Fernand LEGER (1881-1955). 1.0%

31. Wassily KANDINSKY (1866-1944). 1.0%

32. Paul CEZANNE (1839-1906). 1.0%

33. Ed RUSCHA (1937-). 0.9%

34. Pierre-Auguste RENOIR (1841-1919). 0.9%

35. CHU Teh-Chun (1920-2014). 0.9%

36. Peter DOIG (1959-). 0.9%

37. George CONDO (1957-). 0.8%

38. PAN Tianshou (1897-1971). 0.8%

39. Christopher WOOL (1955-). 0.8%

40. Franois-Xavier LALANNE (1927-2008). 0.8%

41. KAWS (1974-). 0.7%

42. LIN Fengmian (1900-1991). 0.7%

43. Jeff KOONS (1955-). 0.7%

44. Pierre SOULAGES (1919-2022). 0.7%

45. Henry MOORE (1898-1986). 0.6%

46. Frank STELLA (1936-). 0.6%

47. Keith HARING (1958-1990). 0.6%

48. Edgar DEGAS (1834-1917). 0.6%

49. Camille PISSARRO (1830-1903). 0.6%

50. Robert RAUSCHENBERG (1925-2008). 0.6%

51. Paul GAUGUIN (1848-1903). 0.6%

52. PU Ru (1896-1963). 0.6%

53. Morton Wayne THIEBAUD (1920-2021). 0.6%

54. ZHOU Chunya (1955-). 0.6%

55. Richard PRINCE (1949-). 0.5%

56. Sigmar POLKE (1941-2010). 0.5%

57. ZENG Fanzhi (1964-). 0.5%

58. Louise BOURGEOIS (1911-2010). 0.5%

59. Rudolf STINGEL (1956-). 0.5%

60. Damien HIRST (1965-). 0.5%

61. Paul SIGNAC (1863-1935). 0.5%

62. Constantin BRANCUSI (1876-1957). 0.5%

63. LIU Ye (1964-). 0.5%

64. Tsuguharu FOUJITA (1886-1968). 0.4%

65. Georgia O'KEEFFE (1887-1986). 0.4%

66. Georg BASELITZ (1938-). 0.4%

67. Auguste RODIN (1840-1917). 0.4%

68. Whan-Ki KIM (1913-1974). 0.4%

69. Salvador DALI (1904-1989). 0.4%

70. Fernando BOTERO (1932-). 0.4%

71. Ufan LEE (1936-). 0.4%

72. Nicolas DE STAL (1914-1955). 0.4%

73. Jasper JOHNS (1930-). 0.4%

74. Ernst Ludwig KIRCHNER (1880-1938). 0.4%

75. Adrian GHENIE (1977-). 0.4%

76. Norman Perceval ROCKWELL (1894-1978). 0.4%

77. Bernard BUFFET (1928-1999). 0.4%

78. Albert OEHLEN (1954-). 0.4%

79. Sam FRANCIS (1923-1994). 0.4%

80. Helen FRANKENTHALER (1928-2011). 0.3%

81. ZHANG Xiaogang (1958-). 0.3%

82. Donald JUDD (1928-1994). 0.3%

83. DONG Qichang (1555-1636). 0.3%

84. WU Hufan (1894-1968). 0.3%

85. Takashi MURAKAMI (1962-). 0.3%

86. Brice MARDEN (1938-). 0.3%

87. Agnes MARTIN (1912-2004). 0.3%

88. Egon SCHIELE (1890-1918). 0.3%

89. Pierre BONNARD (1867-1947). 0.3%

90. Kazuo SHIRAGA (1924-2008). 0.3%

91. Yves KLEIN (1928-1962). 0.3%

92. Tamara DE LEMPICKA (1898-1980). 0.3%

93. Francis PICABIA (1879-1953). 0.3%

94. Max ERNST (1891-1976). 0.3%

95. Gustav KLIMT (1862-1918). 0.3%

96. Ellsworth KELLY (1923-2015). 0.3%

97. Jean-Paul RIOPELLE (1923-2002). 0.3%

98. Robert MOTHERWELL (1915-1991). 0.3%

99. WEN Zhengming (1470-1559). 0.3%

100. Tom WESSELMANN (1931-2004). 0.3%

Images: [https://imgpublic.artprice.com/img/wp/sites/11/2023/01/image1-artprice100-vs-sp500.png]

[https://imgpublic.artprice.com/img/wp/sites/11/2023/01/image2-artprice-global-index.png]

Copyright 1987-2023 thierry Ehrmann www.artprice.com - www.artmarket.com

- Don't hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: econometrics@artprice.com

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

About Artmarket:

Artmarket.com is listed on Eurolist by Euronext Paris, SRD long only and Euroclear: 7478 - Bloomberg: PRC - Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who's who ©:

Biographie_thierry_Ehrmann_2022_WhosWhoInFrance.pdf

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information in databanks containing over 30 million indices and auction results, covering more than 800,000 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world's leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 6400 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million ('members log in'+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France's Commercial Code).

Artmarket with its Artprice department, has been awarded the State label "Innovative Company" by the Public Investment Bank (BPI) (for the second time in November 2018 for a new period of 3 years) which is supporting the company in its project to consolidate its position as a global player in the market art.

Artprice releases its 2022 Ultra-Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2022

The Artprice 2022 half-year report: the art market returns to strong growth in the West:

https://www.artprice.com/artprice-reports/global-art-market-in-h1-2022-by-artprice-com

Artprice by Artmarket's 2020 Global Art Market Report published in March 2022:

https://www.artprice.com/artprice-reports/the-art-market-in-2021

Artprice's 2020/21 Contemporary Art Market Report by Artmarket.com:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2021

Index of press releases posted by Artmarket with its Artprice department:

serveur.serveur.com/Press_Release/pressreleaseEN.htm

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 5.9 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum "The Abode of Chaos" (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

- L'Obs - The Museum of the Future: https://youtu.be/29LXBPJrs-o

- www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4 million followers)

- https://vimeo.com/124643720

Contact Artmarket.com and its Artprice department - Contact: Thierry Ehrmann ir@artmarket.com