|

A divide: In 2021, 80% of private investment in infrastructure projects occurred in high-income countries.

Resilient performance: Rising inflation and interest rates affected infrastructure less than other asset classes.

Green lining: In 2021 60% of private investment in infrastructure projects was green.

SYDNEY, Oct. 13, 2022 /PRNewswire/ -- Private investment in infrastructure projects is tumbling in middle-and low-income countries where investment is needed most, according to a new report now published by the Global Infrastructure Hub (GI Hub). While investment grew by 8.3% in high-income countries in 2021, it fell for a third year in middle- and low-income countries, by 8.8%.

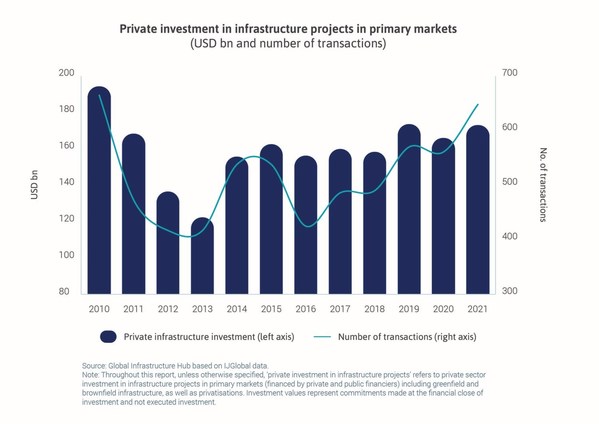

At the same time, the Infrastructure Monitor 2022 report shows overall private investment in infrastructure projects is stagnant for the eighth year running, despite recovering to pre-pandemic levels. As we saw from the COVID-19 pandemic, lack of investment in sufficient, resilient infrastructure leaves people everywhere vulnerable – to inadequate health care, increased unemployment, poverty, and other devastating effects.

The flatlining private investment is particularly notable alongside rising levels of dry powder and the strong performance of infrastructure investments.

"Dry powder - that is, available but uninvested private capital - has quadrupled since 2010, to USD298 billion," said GI Hub Chief Executive Officer Marie Lam-Frendo. "It is unacceptable that we aren't investing in badly needed infrastructure when we have the capital, and we know investments in infrastructure exhibit strong performance compared with investments in other asset classes."

The report finds a 'green lining' in unprecedented levels of green private investment, largely in the renewable energy sector. However, green investment outside renewables remains low and needs to grow to meet climate goals.

"We cannot afford to ignore either the infrastructure investment crisis or the climate crisis. Through public and private sector collaboration, we can work towards solving both," said Lam-Frendo. "The immediate and absolute priority for the infrastructure community is to join forces and activate a massive surge in investment."

Infrastructure Monitor 2022 provides governments and investors with data insights to target their investments for maximum impact. This is the third edition of the GI Hub's flagship report and covers trends in:

- Private investment in infrastructure projects

- Infrastructure investment performance

- Availability of private capital for infrastructure

- The role of multilateral development banks in private investment in infrastructure.