Tracking lifestyle consumption drivers & trends across Asia

HONG KONG, July 20, 2022 /PRNewswire/ -- Asia's leading brand distributor and operator Bluebell Group released today the second volume of the "Asia Lifestyle Consumer Profile". Based on an Asia-wide survey covering 2,100 premium lifestyle consumers across 6 markets - Mainland China, Japan, South Korea, Hong Kong, Taiwan and Southeast Asia (Singapore and Malaysia) – the study outlines five leading consumer personas and sheds light on evolving trends shaping consumption across premium and luxury segments including fashion, accessories & footwear, beauty, fragrance & make-up, active lifestyle and jewellery & watch.

"Last year we launched the first edition of the Asia Lifestyle Consumer Profile to understand the differences and commonalities in consumer outlooks across Asia", said Bluebell Group President and CEO, Ashley Micklewright. "With this second volume, keeping in mind the different post-COVID policies in each market, we explore the evolution of these trends and of the main consumer personas in Asia, and dive deeper into some of the biggest opportunities for lifestyle retail, from Instagram preferences to the growing appetite for niche brands, second-hand products and eco-conscious desires."

Movers and shakers (updates from 2021)

- Across all markets in Asia, consumers are increasingly showing interest in niche brands that fewer people know about, but that offer great style and quality. The biggest year-on-year increases in consumer interest for this brand category are found in Mainland China (+34%), Taiwan (+31%) and Japan (+31%).

- Second-hand products are also slowly winning hearts, again with a year-on-year increase in consumer openness across all markets, led by the largest increase in interest from Japan (+22%) and Taiwan (+26%).

- Meanwhile, demand for brand experiences (through events, tech, entertainment, gaming) continues to grow, with the highest year-on-year increases in consumer interest in Japan (+27%) and Hong Kong (+8%).

- More unequal across Asia, we see interest in home entertainment & home spa gaining traction in Japan (+7% interest year-on-year), while losing ground in South Korea (-11%) and South-East Asia (-8%).

- Finally, interest in products associated with healthy / active lifestyle is down overall, with the biggest year-on-year decreases in interest in South Korea (-8%) and Taiwan (-6%).

Channels of Influence:

Social media, websites and friends & family are the most influential channels for brand preference and purchase decisions

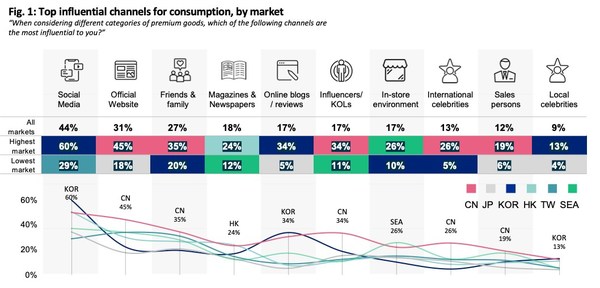

For all product categories, social media remains the most effective channel for brands to engage and inspire consumers to purchase their products: 44% of consumers count it among the channels that have the most influence on them (Fig. 1). This is followed by official websites (31%) and recommendations by friends or family (27%). Interestingly, international celebrities are said to be more influential than local celebrities.

Different channels enjoy different levels of influence across Asia

When considering all categories of premium goods, South Korean consumers are the most likely to feel influenced by social media and online blogs and reviews (60% and 34% respectively, while consumers in South-East Asia are the most likely to feel influenced by the in-store environment (26%). Magazines & Newspapers enjoy the greatest popularity among Hong Kong consumers.

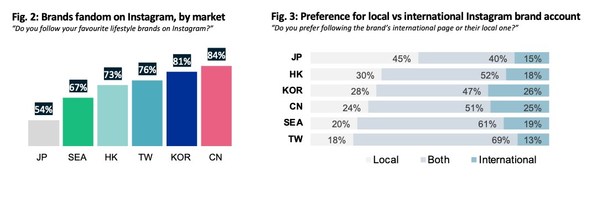

Instagram: not just in the West

On average, social media is found to be the most influential channel in Asia (selected by 44% of respondents). Instagram seems to be gaining traction, even in markets across Asia that have strong local social media channels. Mainland China, South Korea and Taiwan count the highest percentage of followers on Instagram (84%, 81% and 76% respectively, Fig. 2), while Japan counts the lowest (54%). Digging deeper into Instagram, consumers across most markets show almost equal interest in local and/or international accounts (Fig. 3), except for Japan and Hong Kong, where Instagram followers are significantly more interested in local accounts (45% and 30%, respectively) than international ones.

Consumer personas

Against this backdrop of evolving consumer sentiment and behaviours, Bluebell Group has updated five broad consumer personas driving consumption trends across Asia in 2022.

- Experientialist: From culture to entertainment and content, "immersion" is the name of the game for experientialists who want to feel part of a brand's universe.

- Neophilist: From niche brands to mix & matched products and the rising pre-owned market, neophilists are drawn to originality.

- Traditionalist: Traditionalists look for the quintessential luxury shopping experience: big names, in-store service and a sense of status.

- Idealist: Idealists want to feel good about their purchase, and care about brands' ethics and values – but may still be driven by other priorities.

- Comfort-me-ist: From their body to their home, consumers are paying attention to clean and natural options to feel healthier and more comfortable.

To download the full report, please visit https://www.bluebellgroup.com/market-insights/.

About Bluebell Group

Bluebell Group has pioneered building successful brands in Asia since 1954. As Asia's partner of choice, Bluebell Group is present in Japan, South Korea, Mainland China, Hong Kong SAR, Taiwan, Macau SAR, Singapore, Malaysia, Cambodia and Australia.

The Group's distribution network includes flagship stores, shop-in-shops, counters, its own multi-brand concepts, as well as a highly selective wholesale network, together with both direct e-commerce and marketplaces, covering both domestic and Travel Retail.

The Group operates across multiple product categories: Accessories, Footwear, Apparel, Fragrance, Beauty, Gourmet, Jewellery, Watches, Eyewear and Tobacco.

A family-owned group, Bluebell Group today has over 3,800 employees, 650 points-of-sale, US$2b in turnover.

Media Contact:

Anne Geronimi

Group Communication Director

ageronimi@bluebellgroup.com